It was first of all listed in the double fixing segment, but since 28 May 2014, Ascencio has been listed on the continuous market following the conclusion of a liquidity and market-making contract with the company Petercam.

Key figures

| Key figures of the share | 30/09/2024 | 30/09/2023 | 30/09/2022 | 30/09/2021 | 30/09/2020 |

|---|---|---|---|---|---|

| Total number of shares | 6,595,985 | 6,595,985 | 6,595,985 | 6,595,985 | 6,595,985 |

| Total number of shares listed on the stock exchange | 6,595,985 | 6,595,985 | 6,595,985 | 6,595,985 | 6,595,985 |

| Highest price (€) | 50.30 | 55.60 | 56.00 | 51.50 | 60.00 |

| Lowest price (€) | 39.00 | 40.20 | 45.25 | 40.45 | 38.15 |

| Closing price as at 30/09 (€) | 48.65 | 41.30 | 50.70 | 49.10 | 41.80 |

| Market capitalisation (000€) | 320,895 | 272,414 | 334,416 | 323,863 | 275,712 |

| IFRS NAV per share (€) | 67.15 | 67.43 | 66.25 | 56.15 | 52.88 |

| EPRA NAV per share (in €) | 65.80 | 63.59 | 62.35 | 57.37 | 54.90 |

| Premium (+) Discount (-) | -27.6% | -38.8% | -23.5% | -12.6% | -21.0% |

| Annual volume | 1.746.719 | 916,940 | 1,593,971 | 1,129,287 | 1,264,424 |

| Turnover velocity | 26,5% | 13.9% | 24.2% | 17.1% | 19.2% |

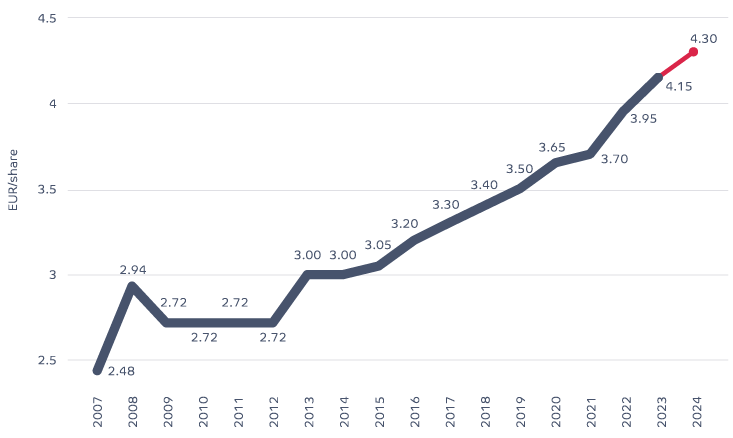

| Gross dividend per share (€) | 4.30 | 4.15 | 3.95 | 3.70 | 3.65 |

| Gross yield | 8.8% | 10.0% | 7.8% | 7.5% | 8.7% |

| Payout ratio relative to corrected profit | 79.1% | 78.0% | 76.8% | 79.6% | 80.6% |

Dividend policy

Obligation to distribute dividend

In accordance with the Royal Decree of 13 July 2014 as amended by the Royal Decree of 23 April 2018, on B-REITs, these companies are obliged to distribute at least 80% of the sum of corrected result and net capital gains on the realisation of non-exempt property assets. However, the net decrease in debt during the period may be deducted from the amount to be distributed.

Financial service

The financial services for Ascencio shares is provided free of charge to shareholders by the Banque BNP Paribas Fortis (payment of coupons and share freezing for annual general meetings of shareholders).

BNP Paribas Fortis

Service Recovery (1BE2D),

Montagne du Parc, 3,

1000 Brussels

Growth in gross dividend per share